philadelphia wage tax for non residents

All Philadelphia residents regardless of. Here are the new rates.

Philly S City Council Will Take Up The Wage Tax Refund Extension Mayor Kenney Vetoed Pennsylvania Capital Star

Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike.

. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that. See below to determine your filing frequency. The City of Philadelphia announced yesterday that there will be a wage tax rate increase for non-residents starting July 1 2020.

Wage Tax for Residents of Philadelphia. Effective July 1 2022 the Philadelphia City Wage Tax will decrease for both residents and non-residents. The new non-resident rates will be a flat 344 for Wage Tax and 344 for Earnings Tax they were previously 34481.

Tax rate for nonresidents who work in Philadelphia. The wage tax is Philadelphias single biggest bucket of revenue bringing in more than 15 billion annually. The new rates are as.

Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the. Effective April 1 2020 for employees paid monthly and March 28 2020 for employees paid biweekly the Philadelphia Non-Resident Wage Tax payroll deduction will be. Philadelphia imposes a Wage Tax on all salaries wages commissions and other compensation received by an individual for services.

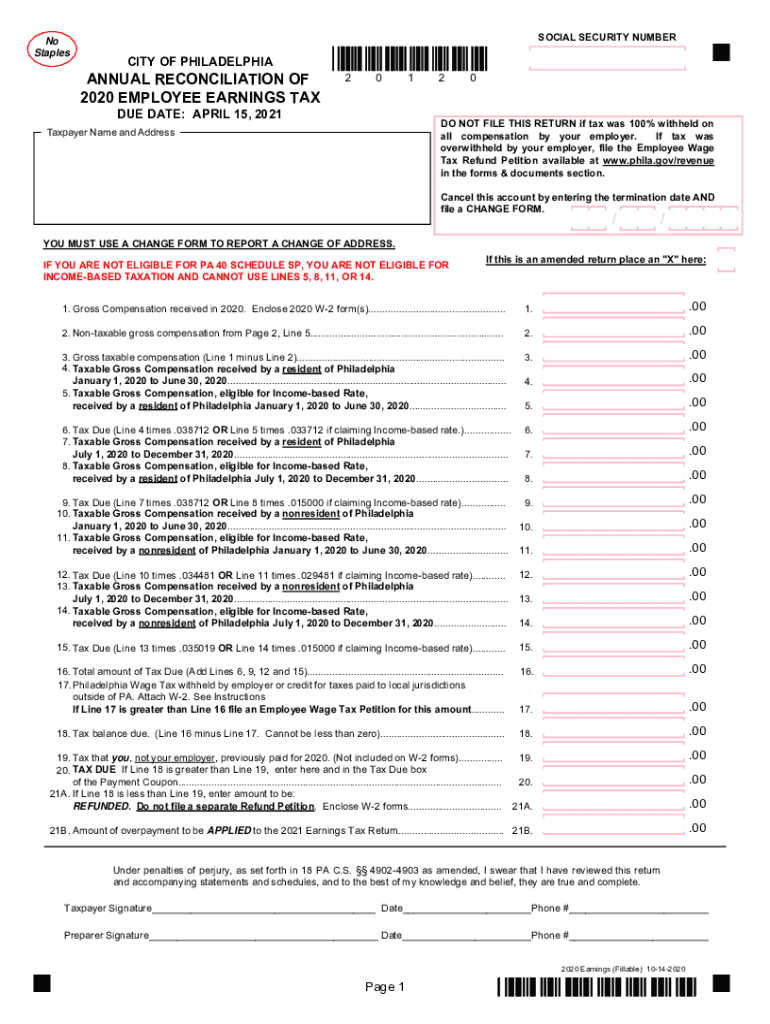

The Wage Tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees paychecks. The City Wage Tax for Philadelphia residents is 38712 and 35019 for non-residents. Effective July 1 2021 the rate for.

A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization. Non-resident employees who had City Wage Tax withheld during the time they. The City of Philadelphia announced yesterday that there will.

The nonresident Earnings Tax rates in Philadelphia Pennsylvania will be. On the other hand if a Philadelphia. Income tax regulations The regulations document puts forth the legal terms of Philadelphias Wage Tax employers.

Non-resident employees who had Wage Tax withheld during the time they were required to perform their duties from home in 2020 can file for a refund with a Wage Tax. Income tax regulations - City of Philadelphia. Employers must begin withholding Wage Tax at.

The City of Philadelphia is decreasing its Wage Tax and Earnings Tax rates for resident and non-resident taxpayers as of July 1 2021. What is Philadelphia income tax rate. 379 0379 Wage Tax.

Why can NJ tax income earned by a NJ non resident. All Philadelphia residents owe the City Wage Tax regardless of where they work. Non-residents who work in Philadelphia must also pay the Wage Tax.

Its just a 0008 decrease in wage tax for non-residents who work. The new non-resident rates will be a flat 344 for Wage Tax and 344 for Earnings Tax they were previously 34481. The new wage tax rate for non-residents who.

Philly Eyes Cuts To City Wage Tax Business Tax Rate Whyy

Pandemic Exposes Dangers Of Philadelphia S Reliance On Wage Tax For City Revenue Philadelphia Business Journal

Kenney Proposes City Wage Tax Reduction As Surging Philadelphia Home Values Increase Property Tax Burden Nbc10 Philadelphia

What Is A Wage Tax And How Did The Pandemic Affect Philly S Technical Ly

Philly Chambers Minority Firms Call For Business And Wage Tax Cuts Pennsylvania Capital Star

Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Fill Out Tax Template Online Us Legal Forms

Philadelphia Wage Tax Refund Opportunities Tax Year 2020 Baker Tilly

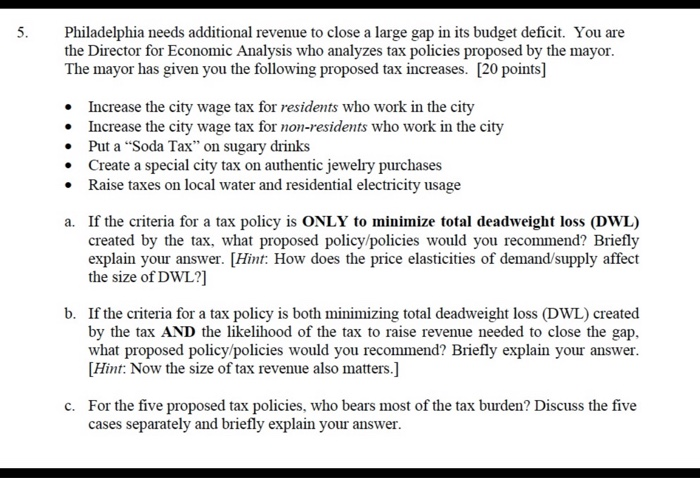

5 Philadelphia Needs Additional Revenue To Close A Chegg Com

How To Get Your 2021 Philadelphia City Wage Tax Refund

Philly S Wage Tax Is The Highest In The Nation Here S Everything You Need To Know About It

Philadelphia City Council Approves Business Wage Tax Cuts In 5 6b Budget Deal Nbc10 Philadelphia

Wage Tax In Philadelphia Employment Lawyer Near Me

Montgomery County Says Enough To Philadelphia Wage Tax

Philly S City Wage Tax Just Turned 75 Here S Its Dubious Legacy Technical Ly

U S Supreme Court Decision Imperils A Portion Of Wage Tax In Philadelphia And Wilmington Officials Unwilling Or Unable To Estimate Likely Budget Impact Whyy

Philly Announces New Tax Rates For Wage Earnings And Other Taxes Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax Cut What Does It Mean For Workers On Top Of Philly News

Philadelphia Just Reduced Birt And Wage Taxes To The Lowest They Ve Been In Decades Who Should Care Citybiz

Philadelphia City Council Approves Business And Wage Tax Cuts In 5 6b Budget Deal Philadelphia Business Journal